Our Approach

Results come from diligence and good decisions. We view every account as a unique relationship, working together towards an end goal. Our process focuses on you – your goals, your level of risk tolerance, and your results using a custom and strategic investment plan.

Our Process

Initial Consultation

A “get to know you” meeting for both parties. We’ll learn about you and your goals, determine fit, discuss expectations, and provide a client questionnaire for your completion.

Create an Investment Policy Statement

Outlines general rules for the investment manager, including your goals and objectives. The Investment Policy Statement describes the strategies that the manager should employ to meet these objectives and discusses asset allocation, risk tolerance, liquidity requirements, and time horizon.

Asset Allocation

Using your Investment Policy Statement, we’ll provide the appropriate asset allocation using a strategic model to provide you with a fully diversified portfolio designed to maximize risk-adjusted return.

Construct the Porfolio

A robust manager selection process results in a list of approved funds with fixed income, equity, and alternative focuses. Regardless of the source, all funds go through the same due diligence vetting process.

Monitor and Adjust

Applying the Investment Policy Statement as a guide, the Detalus team monitors the portfolio and makes adjustments, as needed, to meet investment goals and objectives. Adjustments can be made based on performance, changes in strategy or team, new opportunities, and the overall economic and market environment.

The art and science of manager selection

Sifting through the growing and complex universe of fund managers is an increasingly difficult task. However, our sophisticated, rigorous, and repeatable process allows us to evaluate and appraise managers for quality, performance, and fit, effectively focusing the choices available for you.

Manager Selection Process

Investment Universe

We start with more than 9,200 mutual funds and 1,400+ exchange-traded funds (ETFs). To be considered, each fund must have at least $50 million in assets and 1+ year track record.

Quantitative Screening

Screening on fees, performance, and fund structure is conducted through traditional sourcing channels, including commercial databases and third-party analytic tools. {narrows to 500-600 funds}

Initial Review

Focuses on the quality of the team and investment approach. {narrows to 250 funds}

Qualitative Review

Includes contacting the fund, speaking with product specialists, and reviewing materials. The pros and cons of the strategy are internally discussed to identify strengths and weaknesses. {narrows to 150 funds}

Full Due Diligence

Conducted on the remaining funds. Calls or meetings are held with each manager, and specific questions and data requests are addressed. Historical attribution, prior track records, and back-tested models are reviewed in-depth. {narrows to 20-30 approved funds}

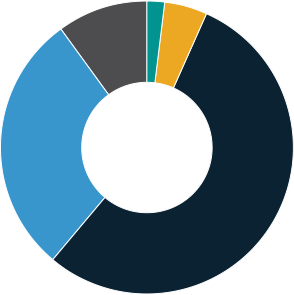

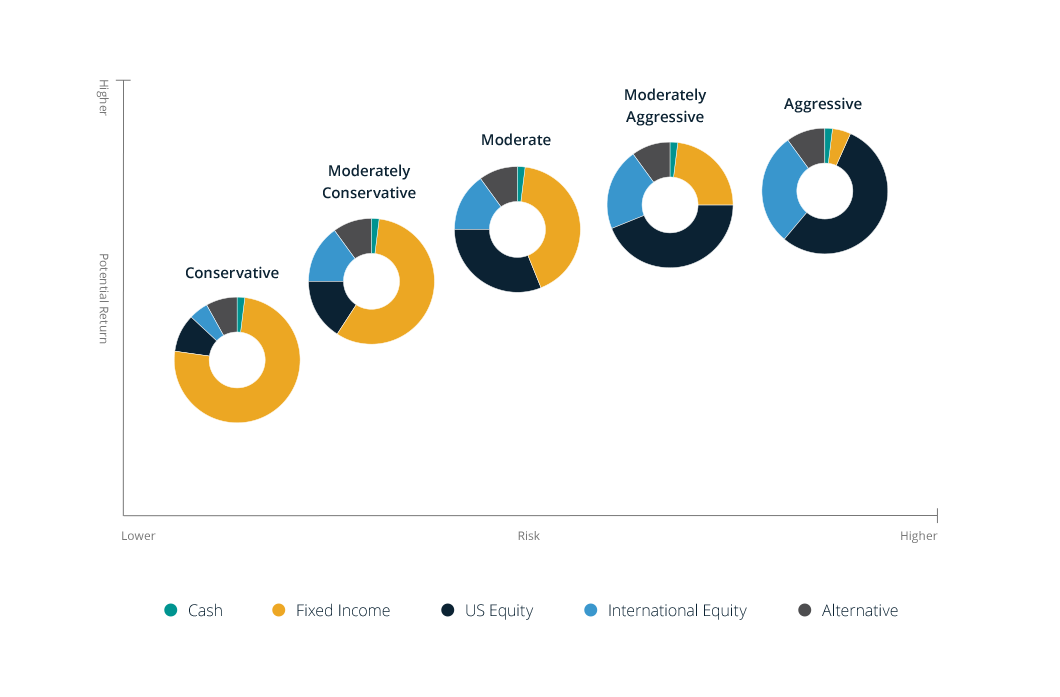

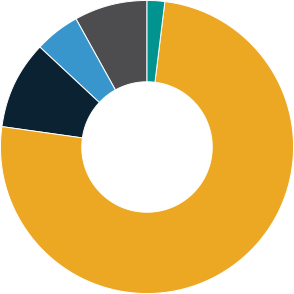

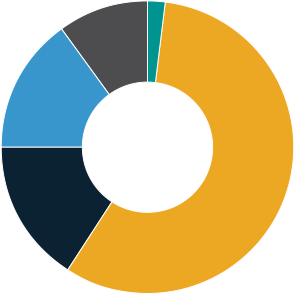

Our Portfolio Models

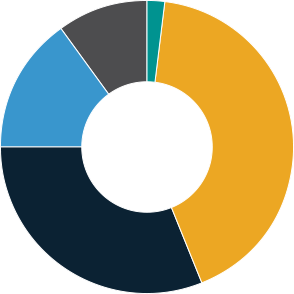

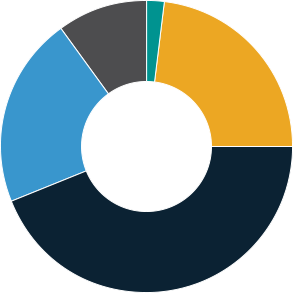

We employ five unique portfolio strategy models to reflect your goals and risk tolerance.

Cash

Fixed Income

US Equity

International Equity

Alternative

Conservative

A conservative investor is looking to preserve the value of the portfolio by minimizing risk and loss of principal. This investor will accept lower returns for a higher degree of liquidity and/or stability.

Moderately Conservative

A Moderately Conservative investor seeks capital preservation but is comfortable with a small degree of risk in return for growth. This investor prefers greater liquidity and is amenable to lower returns and minimal losses.

Moderate

The moderate investor seeks to reduce risks and enhance returns equally. This investor is comfortable with modest risks in order to gain higher long-term returns.

Moderately Aggressive

A moderately aggressive investor values higher long-term returns that may come with significant risk.

Aggressive

An aggressive investor focuses on maximizing returns and will accept a substantial amount of risk. This investor seeks to amplify returns and in doing so may experience considerable volatility and losses. Long-term returns are more important than protecting principal or keeping liquid assets.